Each business transaction is listed in one column and is either positive or negative. It’s possible to split revenue and expenses into separate columns, but because each such accounting transaction is still recorded on a single line, this also qualifies as single-entry bookkeeping. Using double-entry bookkeeping, debits and credits have to match in your reports. If they’re out of balance, you must investigate the discrepancy to identify and fix the error. In single-entry bookkeeping, debits or credits are entered only once so errors can easily go undetected.

To put it another way, this method is accepted by the tax authorities. So you need double-entry over single-entry every time if that’s your goal. Large public companies follow GAAP – Generally Accepted Accounting Principles. So if your startup is aiming to go big, and be worth billions, you need to set up your accounting system correctly from day one.

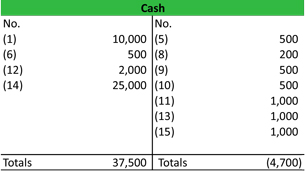

For example, if your business buys or sells on credit, then you need to implement a double-entry system. Some businesses, including publicly owned companies, are legally obligated to followGAAP principles. Private companies that use accrual bookkeeping also have to apply double-entry bookkeeping. Basically, double-entry Single entry bookkeeping provides a 360 degree view of a business’s financial transactions, making financial reporting smoother and operations more transparent. You will note these transactions in a section of the business’s General Ledger. In a double-entry statement, you’ll see debits on the left-hand side and credits on the right.

Responsibility Accounting – Meaning, Types, and Examples

Every transaction has one entry, and most entries record either incoming or outgoing funds. Normally, transactions are recorded in a document called a «cash book» that organizes transactions by details such as date, description, and income or expense type. When compared to single entry accounts, the double-entry system is the more effective technique of recording accounts. In today’s world, double entry bookkeeping is the most common, expected, and effective data entry method. Whether you’re starting from scratch or wanting to upgrade your start-up’s current bookkeeping system, having a proper bookkeeping system is necessary. So, whether you use a single-entry or double-entry bookkeeping system (also known as single-entry or double-entry accounting) it has ramifications for how you handle the rest of your finances.

Introduction to bookkeeping and accounting: 2 5 T-accounts, debits … – The Meghalayan

Introduction to bookkeeping and accounting: 2 5 T-accounts, debits ….

Posted: Tue, 14 Feb 2023 08:00:00 GMT [source]

In fact, it’s too simple for venture-backed startups, or eCommerce companies that are bootstrapping, but trying to get really big. You do not want to do single-entry accounting if you’re running a business of any size. It’s for solo-consultants who are only trying to track their cash flows, really. With single-entry bookkeeping, you record each transaction once in your accounting log. You record the base essentials—date, description, and amount of each transaction—and keep a running total of your balance. The transaction amount will either be a positive value (reflecting income) or a negative value (reflecting expenses).

How Transactions Are Recorded

Single-entry accounting records each transaction one single time, while double-entry accounting records each transaction twice, once as a debit and once as a credit. The disadvantage of single-entry bookkeeping is that it doesn’t include accounts like accounts receivable, accounts payable, and inventory. That means you can’t generate a balance sheet or income statement, which are mandatory for public companies. As a bookkeeping method, very few businesses use single-entry.

- Single-entry bookkeeping is focused on producing this report, which may give small business owners all the tools they need to monitor their business finances themselves.

- Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

- These sorts of accounts are the deciding factor behind the types of double-entry accounting.

- If you are a person who pays great attention to details without leaving anything out of sight, then your accounting method would mean a lot.

- And, it makes it really hard to run your company, because you’re only recognizing expenses when they happen, and you’re only collecting revenue when they happen.

Sections below explain why the vast majority of businesses, large and small, public and private, find the single-entry approach inadequate for meeting their accounting needs. However, under certain conditions, some small businesses can operate successfully with single-entry systems. Single-Entry Accounting is simpler and easier to use than the alternative double-entry approach.

A double-entry bookkeeping system gives a complete picture of your financial health.

Double-entry is just a simple method where an entry is made into one account, and a corresponding entry is made into another account. And this is how you should want to run your company, because it more accurately shows revenue and expenses in the periods that they’re incurred. So, say you hire a web designer to make a really amazing new homepage for your company in February. You would typically, in a different accounting system, in double entry, book that expense in February.

Another form of single-entry bookkeeping separates the revenue and expense by creating separate columns on the statement. Each recorded entry would list the date, description and amount as either revenue or expense with a column for each field. It is not uncommon for columns to be added for specific categories. Examples of these columns include taxes, rent and other such items that are routinely recorded on bookkeeping statements. Public companies are legally required to follow GAAP, but even if your business is a private company or just getting started, it’s good practice to implement GAAP processes as soon as possible. The single entry system is a simplified bookkeeping system where all transactions are recorded in a single journal.

Single-Entry vs. Double-Entry Accounting

Single-entry bookkeeping systems only track revenues and expenses—they do not monitor assets, liabilities, or owners’ equity. Without tracking assets, liabilities, and equity, you cannot generate the proper financial statements (P&L or income statement, balance sheet, and cash flow statement) which startup investors require. For instance, the example above records the debit and credit that occurred in a small business. This method is suitable for businesses that are just starting out. However, it is an inadequate accounting system since it does not record all financial transactions. Instead, it only tracks personal accounts such as debtors, creditors, and cash.

- This makes single-entry much more prone to error and fraud than double-entry.

- Brand Loyalty and Brand Equity—The Ultimate PayoffSuccessful branding is why the Armani name signals style, exclusiveness, desirability.

- Transactions are recorded in a “cash book”—a journal with columns that organize transaction details like date, description, and whether it’s an expense or income.

- Some businesses are required to use double-entry bookkeeping.

- A limited company uses a single entry bookkeeping system to keep track of its finances.

Double-entry bookkeeping is a method of recording transactions where for every business transaction, an entry is recorded in at least two accounts as a debit or credit. In a double-entry system, the amounts recorded as debits must be equal to the amounts recorded as credits. A single-entry bookkeeping system is used to keep track of a business’s finances.

However, every business needs to know about its trading results after specific intervals of time.

The next step is to prepare the second trial balance, which is called the adjusted trial balance, to incorporate adjusting entries. Under this system, personal accounts and a cash book are kept. It is also worth noting that the single entry does not mean the single entry of a transaction. Instead, it only indicates the incomplete nature of the records kept under this system.

Ask Any Financial Question

It requires a minimal number of entries, and a low knowledge of accounting standards. In addition, it can be used to derive the profits generated by a business in short order. This type of accounting with additional information can typically be compiled into an income statement and statement of affairs by a professional accountant. After more information on the difference between single-entry and double-entry systems for bookkeeping? Here are some of the most common questions on the topic—answered. You can also add a little complexity to this system by introducing two columns, one for revenue and one for expenses.

To meet these requirements, every business, large or small, public or private, establishes its own accounting system. Keep in mind that assets and liabilities are harder to track with single-entry bookkeeping. It’s also easier to make common accounting errors because there is no matching system, like with double-entry.

The last line in the cash book should be the cash balance at the end of the accounting period. Another advantage is that if your business is new, small, and has limited activity, this double-entry bookkeeping system gives you everything you need. The chief report produced by single-entry bookkeeping is a business’s income statement, also called a profit and loss report (or a “P&L”). In the interim, the business could have been mistakenly spending money it didn’t have. Equity is the owner’s stake, including owner contributions into the company. Imagine, for example, that you sold all of your assets for cash and used the cash to pay off all your liabilities.